12+ How Do I Figure Out Sales Tax On An Item Ideas in 2022

How do i figure out sales tax on an item. You can find your sales tax rate with a sales tax calculator or by contacting your state taxing authority. This is as long as the item youre selling is subject to sales tax. In case of an item with a price before tax of 100 and a sales tax rate of 5 this tool will return the following results. Thats 100 x 05 5. That entry would be0775 for. The Sales Tax Calculator will calculate the sales tax for any item if you enter in the total purchase amount and the sales tax percentage. This article describes a workaround for including tax in the prices of inventory items. For instance in Palm Springs California the total sales tax percentage including state county and local taxes is 7 and 34 percent. Tax Included How to Back Out Sales Tax. For example you may have sold an item for 100. Cost of the item x percentage as a decimal sales tax. You do this by taking the final post-tax sales price of an item subtracting the pre-tax price of the item from it and dividing the whole thing by the pre-tax price of the item.

Step 1 Figure your total sales writing down the total price of the item or items. 505 Total Sales Tax 50 Cost of the Item 100 101 Sales Tax Percentage from Total Simplifying Sales Tax for Your Online Store Calculating sales tax on your own can quickly become a manual burdensome process. Enter the sales tax percentage. If your local sales tax rate is 85 then you would charge 85 sales tax on all transactions. How do i figure out sales tax on an item Calculate the amount of sales tax and total purchase amount given the price of an item and the sales tax rate percentage. To calculate the sales tax that is included in a companys receipts divide the total amount received for the items that are subject to sales tax by 1 the sales tax rate. Finishing the example if an item cost 330 you would multiply. Multiply the sales tax rate expressed as a percentage by the purchase price to calculate the sales tax. Total CostPrice including ST. You buy a car for 20000 dollars and pay 5 in tax. How to calculate sales tax To calculate sales tax of an item simply multiply the cost of the item by the tax rate. Your math would be simply. The 100 percent represents the whole entire pre-tax price of the item in question.

Sales Tax By State Are Grocery Items Taxable Taxjar Blog

Sales Tax By State Are Grocery Items Taxable Taxjar Blog

How do i figure out sales tax on an item If you knew you sold a 50 item with 505 in sales tax you would use this formula to figure out the sales tax percentage.

How do i figure out sales tax on an item. If a receipt doesnt already display your areas sales tax you can look at the dollar amount that the sales tax added to the price of the item and determine what the sales tax percentage is. If you have priced your items with sales tax included youll need to figure out how much tax is owed on the items sold. When you add it to the tax rate you get a total percentage that represents the pre-tax price plus the tax.

Add 100 percent to the sales tax rate. In case of an item with a final price of 112 that includes a sales tax rate of 7 this application will return these results. From there it is a simple subtraction problem to figure out that you paid61 cents in sales tax.

In other words if the sales tax rate is 6 divide the sales taxable receipts by 106. Enter the total amount that you wish to have calculated in order to determine tax on the sale. Since youve figured out the sales tax is 5 that means the total youll pay is 105.

The Sales Tax Calculator will not only calculate sales tax but also show you the total amount that you will have to pay after including the sales tax. Because items can only be taxable or non-taxable the business must manually figure out later the total amount of tax collected. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737.

So if the sales tax in your area is 8.

How do i figure out sales tax on an item So if the sales tax in your area is 8.

How do i figure out sales tax on an item. If your total receipt amount was 5798 and you paid 107 percent in sales tax youd simply plug those numbers into our calculator to find out that your original price before tax was 5737. Because items can only be taxable or non-taxable the business must manually figure out later the total amount of tax collected. The Sales Tax Calculator will not only calculate sales tax but also show you the total amount that you will have to pay after including the sales tax. Since youve figured out the sales tax is 5 that means the total youll pay is 105. Enter the total amount that you wish to have calculated in order to determine tax on the sale. In other words if the sales tax rate is 6 divide the sales taxable receipts by 106. From there it is a simple subtraction problem to figure out that you paid61 cents in sales tax. In case of an item with a final price of 112 that includes a sales tax rate of 7 this application will return these results. Add 100 percent to the sales tax rate. When you add it to the tax rate you get a total percentage that represents the pre-tax price plus the tax. If you have priced your items with sales tax included youll need to figure out how much tax is owed on the items sold.

If a receipt doesnt already display your areas sales tax you can look at the dollar amount that the sales tax added to the price of the item and determine what the sales tax percentage is. How do i figure out sales tax on an item

Indeed lately has been hunted by consumers around us, maybe one of you personally. People now are accustomed to using the net in gadgets to view image and video information for inspiration, and according to the name of this article I will talk about about How Do I Figure Out Sales Tax On An Item.

How do i figure out sales tax on an item. So if the sales tax in your area is 8. So if the sales tax in your area is 8.

If you re looking for How Do I Figure Out Sales Tax On An Item you've come to the right location. We ve got 51 images about how do i figure out sales tax on an item adding images, photos, pictures, backgrounds, and more. In such web page, we additionally provide variety of images available. Such as png, jpg, animated gifs, pic art, symbol, blackandwhite, translucent, etc.

How To Calculate Sales Tax In Excel

How To Calculate Sales Tax In Excel

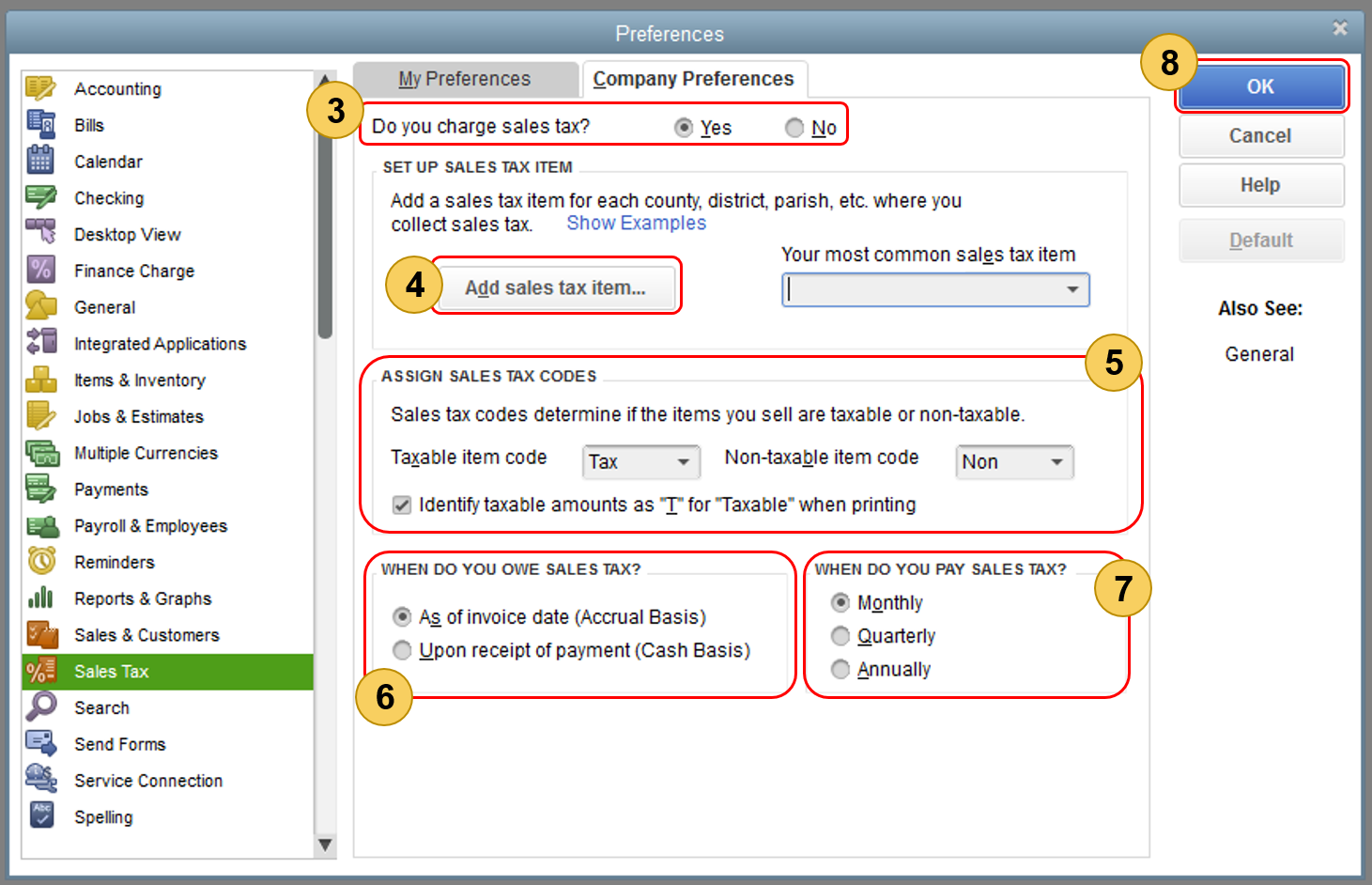

Set Up Sales Tax In Quickbooks Desktop

Set Up Sales Tax In Quickbooks Desktop