10++ How Do I Check My Federal Income Tax Refund Status Free for You

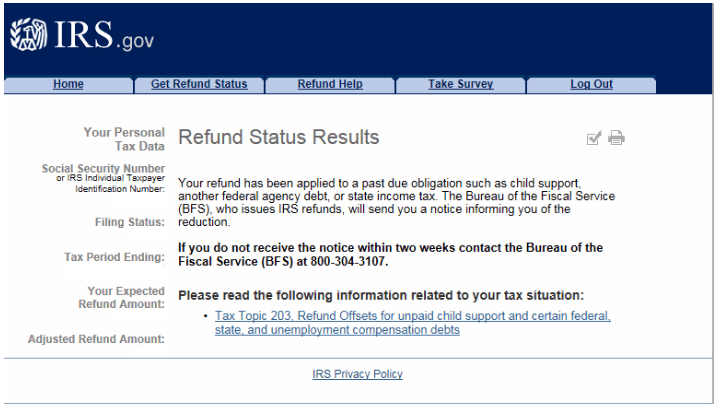

How do i check my federal income tax refund status. Here are the many ways to track your federal tax refund. All that is needed is the taxpayers Social Security number tax filing status single married head of household and exact amount of the tax refund claimed on the return. If you e-filed you can start checking as soon as 24 hours after the IRS accepts your e-filed return. You may also call 1-800-829-4477 to check on the status of your federal income tax refund. Taxpayers on the go can track their return and refund status on their mobile devices using the free IRS2Go app. March 5 2019 The best way to check the status your refund is through Wheres My Refund. If you entered your information correctly youll be taken to a. Wheres My Refund. You can use the Wheres My Amended Return IRS tool. - One of IRSs most popular online features-gives you information about your federal income tax refund. Complete IRS Form 8379 which you can obtain by calling the IRS toll-free at 800 829-3676 or by downloading the form from the IRS Web site at httpwwwirsgovpubirs-pdff8379pdf. COVID-19 Mail Processing Delays Its taking us longer to process mailed documents.

Check your refund status by phone Before you call. Check it carefully so that it matches your exact number any mistake will lead to postponed or even canceled the request. Using the IRS tool Wheres My Refund enter your SSN or ITIN your filing status and your exact refund amount then press Submit. Those who file an amended return should check out the Wheres My Amended Return. How do i check my federal income tax refund status Once youve filed your federal income tax return you can use the Wheres My Refund tool on the IRS website to track any refund you may be owed. You can also check the status of your refund by phone in English or Spanish by calling the refund hotline at 800-829-1954. Line 150 from your most recent assessment. Using the IRS tool Wheres My Refund enter your SSN or ITIN your filing status and your exact refund amount then press Submit. However it is recommended that you wait three weeks after mailing your return to retrieve the most accurate status update. Check Your Refund Status Online in English or Spanish Wheres My Refund. The state doesnt always deduct on the date requestedThe following TurboTax FAQ has the States Department of Revenue sites that you can go to and get info about your state return. The best tool to check the status of your federal tax refund is the IRS Wheres My Refund tool hereThe IRS also has a convenient app for tracking your federal tax refund once you have accepted it. To begin with provide your Social Security Number SSN.

How do i check my federal income tax refund status All you need is internet access and this information.

How do i check my federal income tax refund status. Use our Check Your Refund Status tool or call 1-800-323-4400 toll-free within NJ NY PA DE and MD or 609-826-4400 anywhere for our automated. Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha. For assistance with completing the form call your local IRS office or the IRS toll-free number 800-829-1040.

Individual Income Tax Forms 1040 1040A and 1040EZ please call us toll free at 800-829-4933. You have until April 18 this year to file your taxes. In order to find out your expected refund date you must have the following information.

The primary Social Security Number on the return The filing status used on the return. Updates once every 24 hours usually overnight. The tool tracks your refunds progress through 3 stages.

Your Social Security Number or IRS Individual Taxpayer Identification Number Your Filing Status Single Married Filing Joint Return Married Filing Separate Return Head of Household or Qualifying Widow er. Also a taxpayer should enter the Filing Status along with the expected refund amount. To view Refund Demand Status please follow the below steps.

Your Social Security numbers Your filing status Your exact whole dollar refund amount You can start checking on the status of you return within 24 hours after the IRS received your e-filed return or four weeks after mailing a paper return. Below details would be displayed. How about checking the status of an amended tax return.

If you mailed in your return you should wait at least four weeks before checking. To verify your identify youll need. Return Received Refund Approved Refund Sent You get personalized refund information based on the processing of your tax return.

Taxpayers should remember that checking the status more often will not produce new results. Federal Refund Status To get to your refund status youll need to provide the following information as shown on your return. If you need refund information on federal tax returns other than US.

Get information about tax refunds and updates on the status of your e-file or paper tax return. Generally the IRS issues. Full name and date of birth.

Always open automated line No wait times. Check Federal Tax Refund Find out how to check your federal tax refund status online. This tool shows updates for amended returns for current years and up to three prior years.

If you entered your information correctly youll be taken to a. Go to My Account and click on RefundDemand Status.

How do i check my federal income tax refund status Go to My Account and click on RefundDemand Status.

How do i check my federal income tax refund status. If you entered your information correctly youll be taken to a. This tool shows updates for amended returns for current years and up to three prior years. Check Federal Tax Refund Find out how to check your federal tax refund status online. Always open automated line No wait times. Full name and date of birth. Generally the IRS issues. Get information about tax refunds and updates on the status of your e-file or paper tax return. If you need refund information on federal tax returns other than US. Federal Refund Status To get to your refund status youll need to provide the following information as shown on your return. Taxpayers should remember that checking the status more often will not produce new results. Return Received Refund Approved Refund Sent You get personalized refund information based on the processing of your tax return.

To verify your identify youll need. If you mailed in your return you should wait at least four weeks before checking. How do i check my federal income tax refund status How about checking the status of an amended tax return. Below details would be displayed. Your Social Security numbers Your filing status Your exact whole dollar refund amount You can start checking on the status of you return within 24 hours after the IRS received your e-filed return or four weeks after mailing a paper return. To view Refund Demand Status please follow the below steps. Also a taxpayer should enter the Filing Status along with the expected refund amount. Your Social Security Number or IRS Individual Taxpayer Identification Number Your Filing Status Single Married Filing Joint Return Married Filing Separate Return Head of Household or Qualifying Widow er. The tool tracks your refunds progress through 3 stages. Updates once every 24 hours usually overnight. The primary Social Security Number on the return The filing status used on the return.

Indeed lately is being sought by consumers around us, perhaps one of you. People now are accustomed to using the internet in gadgets to view image and video data for inspiration, and according to the title of the article I will discuss about How Do I Check My Federal Income Tax Refund Status.

In order to find out your expected refund date you must have the following information. You have until April 18 this year to file your taxes. Individual Income Tax Forms 1040 1040A and 1040EZ please call us toll free at 800-829-4933. For assistance with completing the form call your local IRS office or the IRS toll-free number 800-829-1040. Login to e-Filing website with User ID Password Date of Birth Date of Incorporation and Captcha. Use our Check Your Refund Status tool or call 1-800-323-4400 toll-free within NJ NY PA DE and MD or 609-826-4400 anywhere for our automated. How do i check my federal income tax refund status .

How do i check my federal income tax refund status

How do i check my federal income tax refund status. If you entered your information correctly youll be taken to a. Go to My Account and click on RefundDemand Status. If you entered your information correctly youll be taken to a. Go to My Account and click on RefundDemand Status.

If you are searching for How Do I Check My Federal Income Tax Refund Status you've arrived at the right place. We have 51 images about how do i check my federal income tax refund status including pictures, pictures, photos, wallpapers, and much more. In such page, we also provide number of graphics available. Such as png, jpg, animated gifs, pic art, logo, blackandwhite, transparent, etc.