32+ How Long Before Something Is Removed From Your Credit Report Information

How long before something is removed from your credit report. They cannot promise to remove accurate information from a credit report prior to the term set by law seven years ten years for some bankruptcies. A history of your payments will remain on your credit report for 7 years for reference. Avoid closing unused credit cards. All three Credit Bureaus will have the dispute comments removed within 24-72 hours. But if you are. There is no requirement in the FCRA for credit reporting agencies to remove positive information such as on-time credit paymentsthey can remain on your credit reports indefinitely. Goodwill adjustment letters work best for smaller creditors such as utilities and small credit unions. Your credit report if youre not familiar is a document that lists your credit and loan accounts and payment histories with various banks and other financial institutions. A payment that is 30 or 60 days late generally wont affect your credit score as much as a payment thats 90 days past due. As long as theyre not costing you money in fees its smart to keep unused credit cards open. This will not lower or heighten your credit score. You can remove derogatory items from your credit report before seven 7 years.

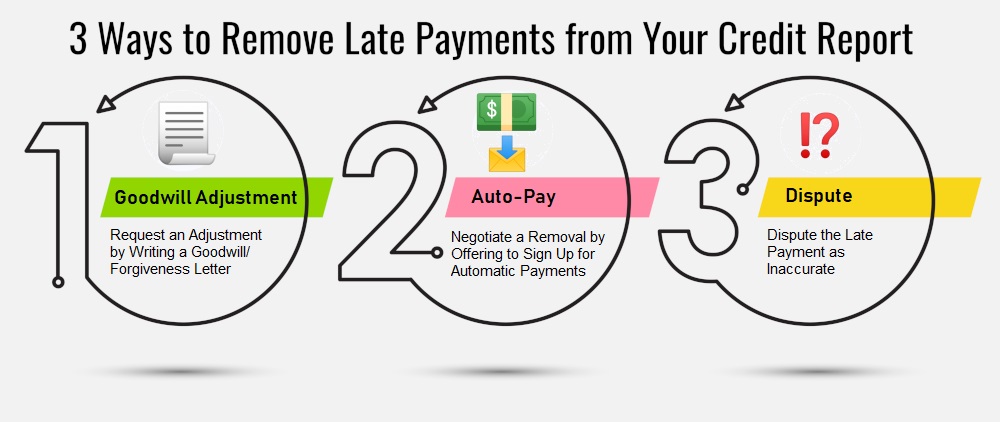

Each method will work some of the time. The consumer will have three days in which to review the contract and cancel without penalty. If you stay focused and consistent you can remove your negatives before seven years. Its in your best interest to start cleaning up your credit report if you want to get a mortgage car loan insurance or even a new job. How long before something is removed from your credit report How to Remove Settled Accounts from Credit Reports. While you may not be able to remove a legitimate charge-off from your credit report finding a way to pay the debt partially or in full is an important step toward rehabilitating your credit. However not all late payments are equal. Most negative items will simply fall off your credit report automatically after seven years from the date of your first missed payment. You can use Goodwill letters negotiate deletions for payment or send disputes. Most negative items should automatically fall off your credit reports seven years from the date of your first missed payment at which point your credit scores may start rising. You will now need to call each Credit Bureau that lists dispute comments on your report. The same is true of all late payments. You can also write letters directly to the credit bureaus.

How To Remove Late Payments From Your Credit Report

How To Remove Late Payments From Your Credit Report

How long before something is removed from your credit report How to settle the outstanding account and remove it from a credit report can be tricky because some accounts can only be removed in specific situations.

/remove-debt-collections-from-your-credit-report-960376_FINAL-5ae6517517024613885ec46df1e58ecd.png)

How long before something is removed from your credit report. Collection accounts remain on your credit report for around seven years after the date you first became delinquent with the lender. Even after a positive account has been closed or paid off it will still remain on your credit reports for as long. Get a copy of your credit report Once you have your credit report write down the accounts that you need to remove disputes from.

The length of time negative information can remain on your credit report is governed by a federal law known as the Fair Credit Reporting Act FCRA. November 7 2020 Credit If you have negative items on your credit report its a good idea to try to get them removed so that you dont have to wait 7 years to have good credit. Most negative information must be taken off.

The biggest benefit of paying in full or settling a charge-off is that you wont be sued for the debt and you stop accruing interest on the debt says. A goodwill adjustment allows a creditor to remove the late payment from your credit report. Taking on unnecessary credit can harm your credit score in multiple ways from causing too many hard inquiries on your credit report to tempting you to overspend and drive up your debt.

How long before something is removed from your credit report Taking on unnecessary credit can harm your credit score in multiple ways from causing too many hard inquiries on your credit report to tempting you to overspend and drive up your debt.

How long before something is removed from your credit report. A goodwill adjustment allows a creditor to remove the late payment from your credit report. The biggest benefit of paying in full or settling a charge-off is that you wont be sued for the debt and you stop accruing interest on the debt says. Most negative information must be taken off. November 7 2020 Credit If you have negative items on your credit report its a good idea to try to get them removed so that you dont have to wait 7 years to have good credit. The length of time negative information can remain on your credit report is governed by a federal law known as the Fair Credit Reporting Act FCRA. Get a copy of your credit report Once you have your credit report write down the accounts that you need to remove disputes from. Even after a positive account has been closed or paid off it will still remain on your credit reports for as long. Collection accounts remain on your credit report for around seven years after the date you first became delinquent with the lender.

How long before something is removed from your credit report

Indeed recently has been sought by consumers around us, maybe one of you. People now are accustomed to using the net in gadgets to see video and image information for inspiration, and according to the name of the post I will talk about about How Long Before Something Is Removed From Your Credit Report.

How long before something is removed from your credit report. The biggest benefit of paying in full or settling a charge-off is that you wont be sued for the debt and you stop accruing interest on the debt says. A goodwill adjustment allows a creditor to remove the late payment from your credit report. Taking on unnecessary credit can harm your credit score in multiple ways from causing too many hard inquiries on your credit report to tempting you to overspend and drive up your debt. The biggest benefit of paying in full or settling a charge-off is that you wont be sued for the debt and you stop accruing interest on the debt says. A goodwill adjustment allows a creditor to remove the late payment from your credit report. Taking on unnecessary credit can harm your credit score in multiple ways from causing too many hard inquiries on your credit report to tempting you to overspend and drive up your debt.

If you are looking for How Long Before Something Is Removed From Your Credit Report you've reached the right location. We ve got 51 images about how long before something is removed from your credit report adding pictures, photos, pictures, wallpapers, and much more. In these webpage, we also have variety of images out there. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.